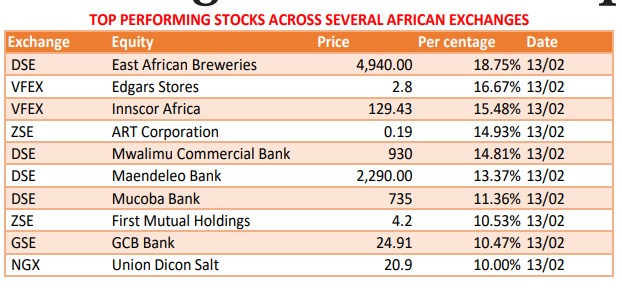

DAR ES SALAAM: THE Dar es Salaam Stock Exchange (DSE) has emerged as the dominant force in last week’s African equity rally, accounting for four of the continent’s 10 top-performing stocks, according to data compiled from African Markets.

Leading the charge was East African Breweries Limited (EABL), which surged 18.75 per cent to close at 4,940/-, making it the single bestperforming stock among the surveyed African exchanges for the week.

The sharp rally in the regional beverage giant points to strong institutional demand, likely driven by upbeat earnings expectations and renewed investor appetite for consumerfacing counters.

EABL’s performance placed it ahead of peers listed on the Victoria Falls Stock Exchange (VFEX), the Zimbabwe Stock Exchange (ZSE), the Ghana Stock Exchange (GSE) and Tunisia’s Bourse de Tunis (BVMT).

The strong showing underscores the DSE’s growing influence in regional capital flows, with both banking and consumer stocks attracting heightened investor interest. Financial counters were among the week’s biggest movers. Mwalimu Commercial Bank climbed 14.81 per cent to 930/-, while Maendeleo Bank rose 13.37 per cent to 2,290/- and Mucoba Bank gained 11.36 per cent to 735/-.

ALSO READ: Growing fibre internet solutions redefine user experience

The cluster of double-digit gains in the banking sector signals renewed positioning in domestic lenders, as investors bet on sustained credit growth, stable macroeconomic fundamentals and strengthening balance sheets.

Across the continent, Zimbabwean counters also featured prominently. Edgars Stores Limited advanced 16.67 per cent on the VFEX, while Innscor Africa Limited gained 15.48 per cent.

On the ZSE, ART Corporation Limited rose 14.93 per cent and First Mutual Holdings Limited added 10.53 per cent, reflecting selective strength in a market often navigating currency and liquidity pressures. Elsewhere, Société Chimique Alkimia posted a 13.53 per cent gain on the BVMT, while GCB Bank Plc climbed 10.47 per cent on the GSE.

Still, it was Tanzania’s bourse that stood out for both breadth and momentum. Analysts say the rally in EABL, widely regarded as a consumer bellwether, may signal expectations of resilient household demand and expanded regional distribution. Meanwhile, the synchronised rise in Tanzanian banking stocks suggests broader market participation rather than isolated blue-chip gains.

With four of Africa’s top 10 gainers originating from Dar es Salaam, the latest performance highlights Tanzania’s rising profile among frontier markets and positions the DSE as a key driver of regional equity sentiment.

The diversified composition of the gainers spanning consumer goods, financial services, manufacturing and retail indicates that investor appetite for African equities remains firm, though increasingly concentrated in markets demonstrating liquidity, earnings visibility and policy stability.

For now, the DSE’s commanding presence at the top of the leaderboard reinforces its status as one of the continent’s most closely watched frontier exchanges.