Dar es Salaam: Exim Bank Tanzania has concluded its nationwide card usage campaign, ‘Chanja Kijanja, Dili Ndio Hili’, with a grand finale draw marking the close of a two-month initiative focused on supporting customers to use cards for everyday payments.

Launched in December 2025 and running through January 2026, the campaign aimed to build a Tanzania that embraces cashless transactions by rewarding customers for choosing card payments at POS terminals and for e-commerce transactions during high-spending periods.

Over the two months, the campaign recorded strong engagement, with 40 weekly winners receiving 100,000 TZS each and 20 monthly winners receiving 200,000 TZS each, for a total of 60 winners.

Additionally, rewards were given on key shopping days based on the value of transactions made on Black Friday, Cyber Day, and Christmas Day.

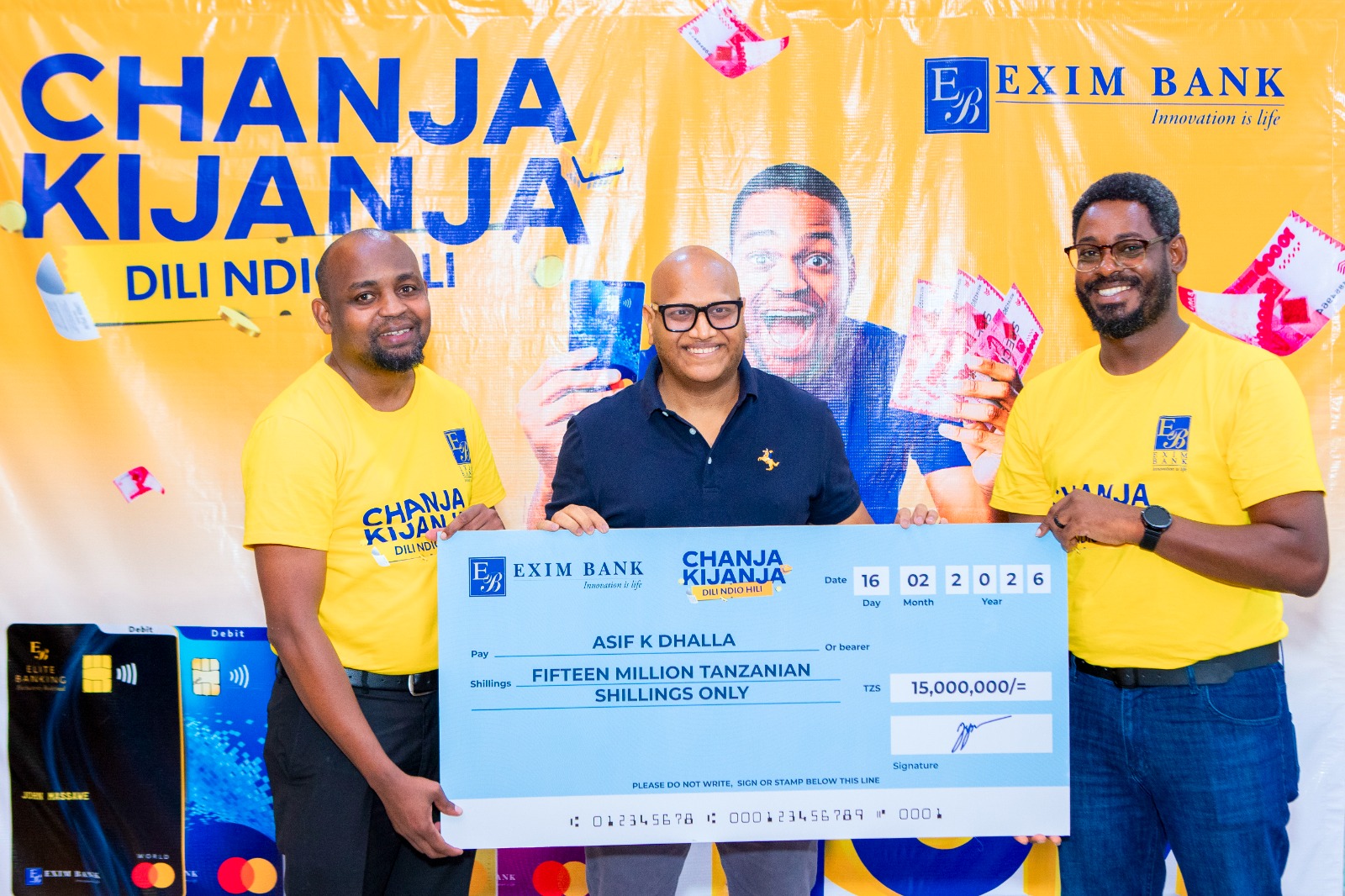

This journey comes to an end in the grand finale draw, where three winners will be awarded TZS 15 million, TZS 10 million, and TZS 5 million respectively.

The official prize handover ceremony will take place at Exim Bank’s newly opened Ubungo Branch, which commenced operations late last year as part of the Bank’s continued efforts to bring banking services closer to communities in the area.

From the first weekly draw to the final selection, Exim Bank has remained committed to transparency and fairness.

All draws have been conducted under the supervision of the Gaming Board of Tanzania, ensuring full compliance with regulatory requirements and reinforcing customer confidence throughout the campaign.

In addition to cash prizes, cardholders who used their Exim Bank cards at partner outlets including Shoppers Plaza, Village Supermarket, Karambezi Café, and the CIP Lounge at the airport benefited from exclusive offers, discounts, and branded gifts, adding further value to everyday spending.

Reflecting on the campaign’s conclusion, Head of Retail Banking at Exim Bank Andrew Lyimo, said the response from customers highlights a growing shift toward digital payment habits.

“As a retail bank, our responsibility is to make everyday banking simple, reliable, and accessible for our customers. ‘Chanja Kijanja, Dili Ndio Hili’ was designed to support customers in their daily payments by giving them a safe and convenient alternative to cash.

The strong participation we saw shows growing trust in card payments, and we remain committed to ensuring our retail customers are well supported as they adopt digital ways of transacting,” said Lyimo.

As customers became more engaged, the campaign also played a broader role in advancing digital adoption. According to Silas Matoi, Head of Alternative Channels and Digital Transformation at Exim Bank, the initiative focused on building confidence and fostering long-term behavioural change.

“This campaign went beyond prizes. It was designed to help customers see the convenience and security of using cards for everyday payments. By encouraging card usage, we are supporting the country’s move toward a cash-lite economy and helping customers feel confident using digital channels for their daily needs,” said Matoi.

At the heart of the campaign was a strong focus on customer appreciation. Head of Marketing and Communications at Exim Bank Stanley Kafu, said the initiative was shaped around real customer experiences and lifestyles.

“Our customers trust us with their daily transactions, and this campaign was our way of saying thank you. Every swipe, tap, and click mattered. We wanted to recognize that loyalty by offering rewards that added value while making payments easier and more secure,” Kafu said.

Throughout the campaign period, oversight by the Gaming Board of Tanzania ensured that customer trust was protected. A representative from the Board Neema Tatock reaffirmed its role in maintaining integrity across all draws.

“The role of the Gaming Board of Tanzania is to oversee, monitor, and regulate all gaming activities in the country.

In line with Exim Bank’s commitment, all the draws were conducted fairly, transparently, and in accordance with regulatory requirements. This oversight is important for safeguarding public confidence and ensuring participants can take part with assurance,” Neema commented.

As Exim Bank brings the ‘Chanja Kijanja, Dili Ndio Hili’ campaign to a close, the bank has expressed its sincere appreciation to its customers for their trust and active participation throughout the campaign period.

By choosing to use cards for their everyday transactions, customers played a direct role in supporting safer and more efficient payment practices.

Exim Bank also extends its appreciation to campaign partners including Shoppers Plaza, Village Supermarket, Karambezi Café, and the CIP Lounge, whose collaboration helped enhance the customer experience through added value and exclusive benefits.

The bank further acknowledges the role of the Gaming Board of Tanzania for providing regulatory oversight that ensured the integrity of the campaign.

Looking ahead, Exim Bank remains focused on strengthening customer-centric digital banking solutions that respond to real customer needs while supporting Tanzania’s continued transition toward secure and inclusive digital payments.